03

Finances & Endowment

Sub Title

Explore our financial health and foundation to build on

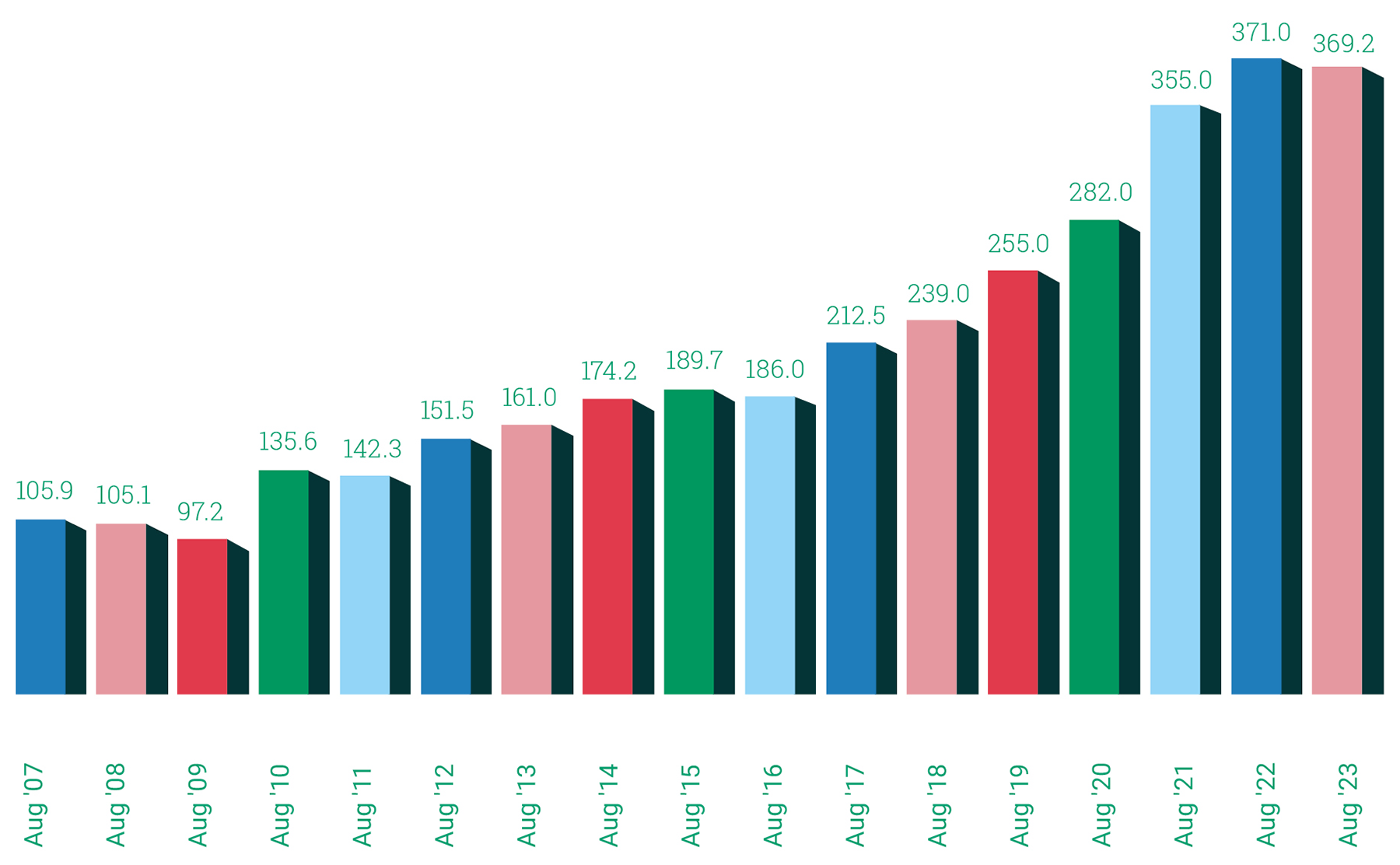

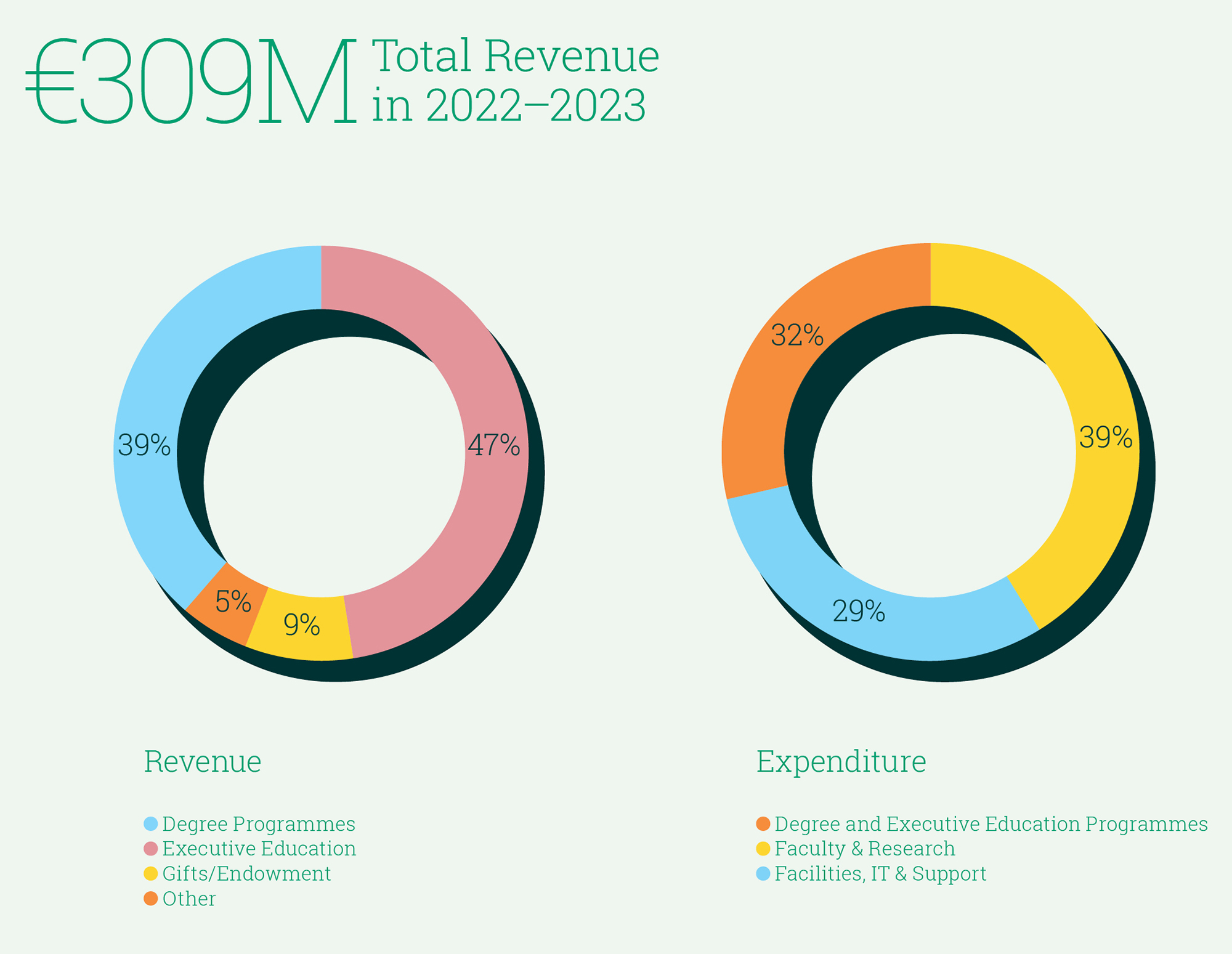

The school was able to celebrate the end of an extraordinary and eventful decade with the announcement of record-breaking annual revenue. For the first time ever, INSEAD broke the €300 million barrier, which represents 100% revenue growth in just ten years. This is all the more impressive given the turmoil in the world economy as a result of Covid-19 and geopolitical upheaval for much of that period. Indeed, the final revenue results exceeded the expectations that we had earlier in the year, thanks largely to the outstanding performance of Executive Education and the dedication of our staff and faculty across the school.

At the same time, the market for Degree Programmes was challenging but is showing signs of a slightly more positive outlook for 2023–2024. Other financial challenges included continued inflationary pressure and the need for significant long-term investment, particularly in the infrastructure of the Europe Campus. Additional participant levels in Executive Education also meant increased expenditure, but we are implementing more focused financial oversight, cost management and supplier negotiations, supported by the efforts of our dedicated Procurement Team.

Looking ahead, we are cautiously optimistic. However, we are taking nothing for granted, especially given our commitment to investing in the Europe Campus Reimagination over the coming years. The project is ambitious, but we will be fundraising for it very actively, and our teams have a strong commitment to ensuring that it runs smoothly to meet the objective of creating a vibrant and sustainable intellectual environment. In summary, INSEAD is beginning an exciting new chapter – and it does so from a strong financial base.

INSEAD is a not-for-profit institution with entities in various countries. Therefore, we are not required to publish consolidated accounts; however, all our statutory accounts are audited. We maintain a governance structure that includes several committees of the Board responsible for Audit, Finance and Risk; Endowment Management; and Remuneration. These financial indicators are directly extracted from audited combined accounts based on International Financial Reporting Standards (IFRS).

The past year presented us with a challenging market landscape, albeit with a gradual shift towards a more positive outlook. Global GDP growth exceeded expectations, with a projected increase of 2.7% for 2023, bolstered by robust consumer spending and exceptionally supportive fiscal policies in the United States. Simultaneously, there was a decline in headline inflation. Central banks responded by moderating the pace of interest rate hikes, while also signalling a potentially prolonged period of elevated rates.

In this context, equities rebounded impressively, registering a growth of +10.1% in the last Academic Year, marking a significant recovery from the -12.2% downturn in the preceding year. However, government bonds continued their downward trajectory, dropping by -2.2% following a challenging 2021–2022, which saw a -15.3% decline. The US Dollar experienced a -8.3% devaluation against the Euro.¹

1. MSCI All Country World Index, with Developed Markets 100% Hedged to Euro, and FTSE EuroBIG TR Euro.

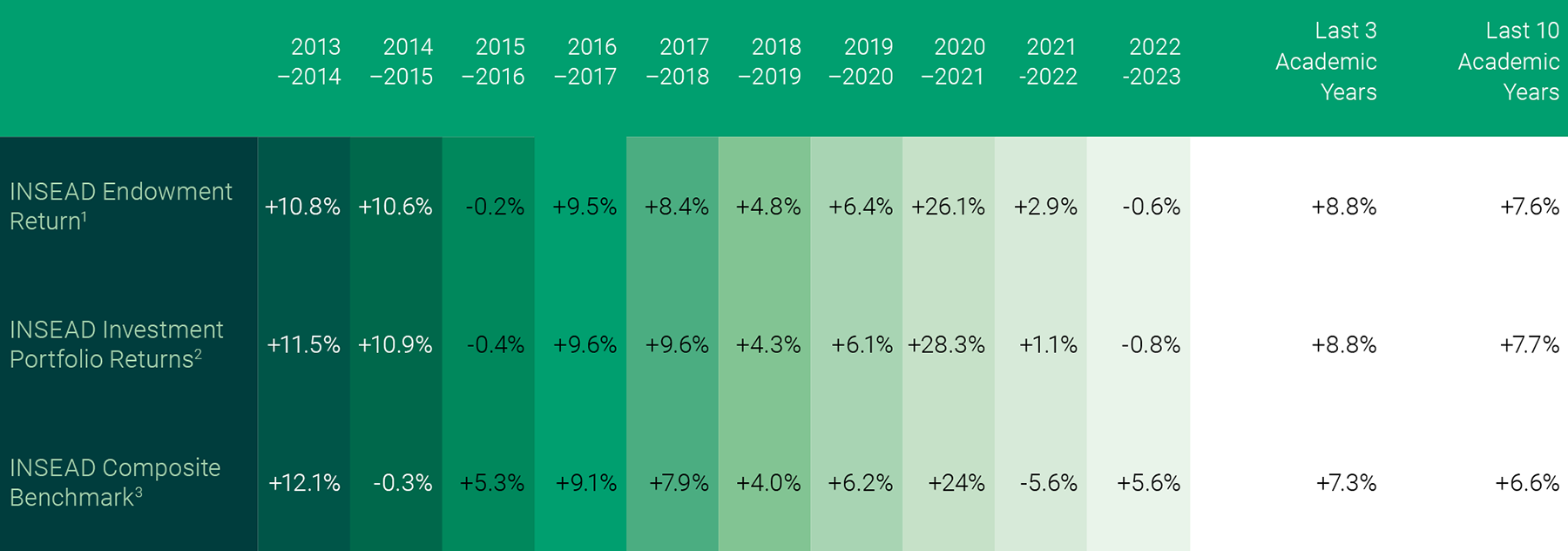

Over the Academic Year, the investment portfolio saw a slight decrease of -0.8% in Euro terms, but an increase of +3.2% in local currency, net of fees and expenses. This performance contrasts with the composite benchmark’s +5.2% rise in local currency, gross of fees. The public market portfolio within the Endowment thrived, showing a +6.4% growth, primarily driven by global equities, absolute return and credit allocations. However, the private markets portfolio remained relatively stagnant, offsetting some of its previous gains. The depreciation of the US Dollar also impacted our Euro-denominated returns. Notably, our portfolio outperformed the majority of the US Ivy League endowments in local currency terms over this period, particularly in light of their larger private market and venture capital allocations, which decreased in value during the year.

Over the past decade, the investment portfolio has grown by +7.7% per annum in Euro terms (net of fees, +7.8% in local currency), surpassing the +6.5% annual growth of the composite benchmark in local currency, gross of fees. The portfolio has cumulatively outperformed its benchmark by 22.5% over this period, with the private market allocations being the most significant contributor, yielding an annual return of +15.3%.

Looking ahead, we remain optimistic about replicating the strong returns of the past decade, while acknowledging the recent paradigm shifts in the economic landscape. The Endowment Management Committee has strategically repositioned the portfolio to leverage macroeconomic volatility, with a focus on augmenting income-producing assets, especially in private credit, and diversifying into less correlated exposures.

The Sustainable Investments sub-committee, under Professor Lucie Tepla’s leadership, continues to refine our commitment to sustainable investing, ensuring the continued integration of environmental, social and governance factors into our investment process.

I extend heartfelt thanks to our donors for their generous support and trust. I also express my gratitude to the members of the Endowment Management Committee for their invaluable guidance and insights, as well as to the INSEAD executive team for their exceptional stewardship of our institution.

On behalf of the Endowment Management Committee, I would like to express our deepest appreciation to Ilian Mihov for his outstanding leadership and commitment to schoolwide excellence, and we warmly welcome Francisco Veloso as the new Dean. We are excited to collaborate with Francisco and his team on strengthening the Endowment, further empowering INSEAD to unite diverse perspectives and cultivate responsible leaders who will positively transform business and society.

Endowment Management Committee Chair

The Endowment’s investment strategy is firmly anchored in maximising long-term risk-adjusted returns, with a strong emphasis on integrating ESG factors into our decision making. We are guided by the following principles:

Private markets (40%): This includes private equity, real estate and private debt, targeting the illiquidity premium typically ranging between +3% and +5%. Our private-market investments are diverse, encompassing venture capital in early-stage tech firms, private equity in lower middle-market companies, European real estate and senior loans to private businesses. We have continued to ramp up our commitments to private debt and to buyout managers with a proven ability to bring value-enhancing operational improvements to their portfolio companies.

Public equities (38%): This, combined with our private-market portfolio, forms the core of our long-term, return-generating strategy. Our public equity investments include a mix of actively managed long-only and long-short funds, alongside passive index trackers.

Credit investments (15%): To capitalise on higher yields, we have increased our allocation to credit investments across both public and private strategies.

Hedge funds and inflation-linked bonds (7%): Our investment in absolute-return hedge funds is designed to yield returns with minimal correlation to traditional assets and thrive in higher volatility. Inflation-linked government bonds offer additional protection against unexpected inflation spikes.

While the Endowment Management Committee holds direct responsibility for our investments, our portfolio is skilfully managed by Partners Capital, our advisors since 2007. We extend our gratitude to Partners Capital for their support in fostering the long-term growth of our Endowment over the last remarkable decade in INSEAD’s history.